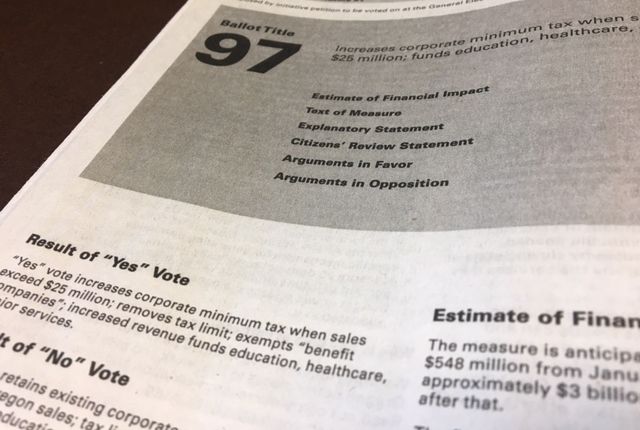

BEND, OR -- One of the most controversial issues on Oregon's November ballot is Measure 97. It would impose a 2.5% sales tax on corporations that do more than $25 million in gross sales in the state. City Club of Central Oregon discussed the proposal at a Thursday forum in Bend.

Tonia Hunt, Executive Director of Children First, supports the measure. "It's time for the voters to do what has to be done. I would say that is your job as a voter to think about what's good for Oregon. And, I think it's good for Oregon to see a game-changing investment in our education system that has been disinvested in for 25 years, which all of our kids are paying the price for."

Oregon State Chamber of Commerce Executive Director Alison Hart advocated against M97. She told the crowd, "I really believe that this is a flawed measure for so many reasons. I want to see our state continue to grow economically. One of the sectors that would be hit very hard in this argument is the tech sector. Right now, the tech sector is the fastest growing employment sector in our economy."

While supporters say the additional state revenue is needed for education, seniors and healthcare, Hart says, "There is no plan for this $6 billion tax increase; that is acutely concerning to me. The Governor has even talked about ideas that she has for the revenues of 97 that did not include those three things." Hunt responded, "We know exactly where these dollars are going to go. And, voters have the opportunity to be very clear with the Legislature. This passes law that says these dollars must be spent on education, healthcare and senior services."

At a Thursday evening debate in Portland, Governor Kate Brown responded to questions about M97, saying, "I will spend Ballot Measure 97 dollars as the voters intended." Republican candidate Dr. Bud Pierce opposes the measure, and said if it passes, "I would look to mitigate the damage to Oregon families and Oregon businesses by trying to get the money back in the hands of Oregon families."

The Legislative Revenue Office estimates the measure will cost average Oregon families $600 more a year if it passes. A recent poll found 47% of respondents oppose M97, while 12% remain undecided.